What is a Home Equity Loan?

A home equity loan is a type of loan that allows homeowners to borrow against the equity in their property. Equity is defined as the difference between the current market value of the home and the outstanding balance on any mortgages. Essentially, if a home is valued at $300,000 and the homeowner owes $200,000, the equity amounts to $100,000. This financial product enables homeowners to leverage that equity for various purposes, such as consolidating debt, funding home renovations, or covering unexpected expenses.

Home equity loans operate on the principle of using the property as collateral for the borrowed amount. When approved for a home equity loan, the homeowner receives a lump sum payment upfront, which is typically repaid over a fixed term at a fixed interest rate. The stability of fixed payments makes this option appealing to many borrowers. Furthermore, the interest on home equity loans may be tax-deductible, providing potential additional savings for homeowners who itemize deductions on their taxes.

It is important to differentiate between a home equity loan and a home equity line of credit (HELOC). While both products allow homeowners to access the equity in their homes, they differ in structure and repayment. A home equity loan provides a one-time lump sum payment, while a HELOC operates similarly to a credit card, allowing homeowners to draw funds as needed against their equity up to a predetermined limit. Additionally, HELOCs often come with variable interest rates, which can fluctuate over time, potentially impacting monthly payments.

Understanding these fundamental concepts surrounding home equity loans and their distinctions from HELOCs is vital for homeowners considering utilizing their home equity for financial needs. Proper comprehension can aid in making informed decisions about which option best suits their financial situation.

Benefits of Taking a Home Equity Loan

Home equity loans present numerous advantages for homeowners looking to access funds. One of the most significant benefits is the lower interest rates compared to unsecured loans. Because these loans are secured by the equity accumulated in one’s home, lenders often offer more favorable terms, resulting in reduced monthly payments for borrowers. This can be particularly beneficial for individuals seeking to finance large expenses such as home renovations, education costs, or debt consolidation.

Furthermore, utilizing a home equity loan can lead to potential tax advantages. The interest paid on a home equity loan may be deductible on federal income tax returns, subject to certain conditions. This tax benefit can further enhance the financial appeal of these loans, making them an attractive option for those looking to optimize their tax situation while managing significant expenditures.

Another noteworthy benefit of a home equity loan is the ability to leverage existing home equity for substantial expenses. Homeowners can tap into their property’s value to fund major projects, consolidate high-interest debts, or cover educational expenses. This flexibility positions a home equity loan as an effective financial tool, facilitating the pursuit of important life goals without incurring additional debt at exorbitant interest rates.

In addition to the financial advantages, home equity loans offer a stable and predictable repayment structure. Borrowers typically receive a lump-sum payment at the beginning, with fixed monthly payments throughout the loan term. This predictability allows for better financial planning and management, as homeowners can budget accordingly and avoid surprises that often come with variable-rate loans.

Overall, the benefits of taking a home equity loan can significantly outweigh traditional borrowing methods, offering homeowners a strategic approach to accessing funds efficiently while maintaining financial stability.

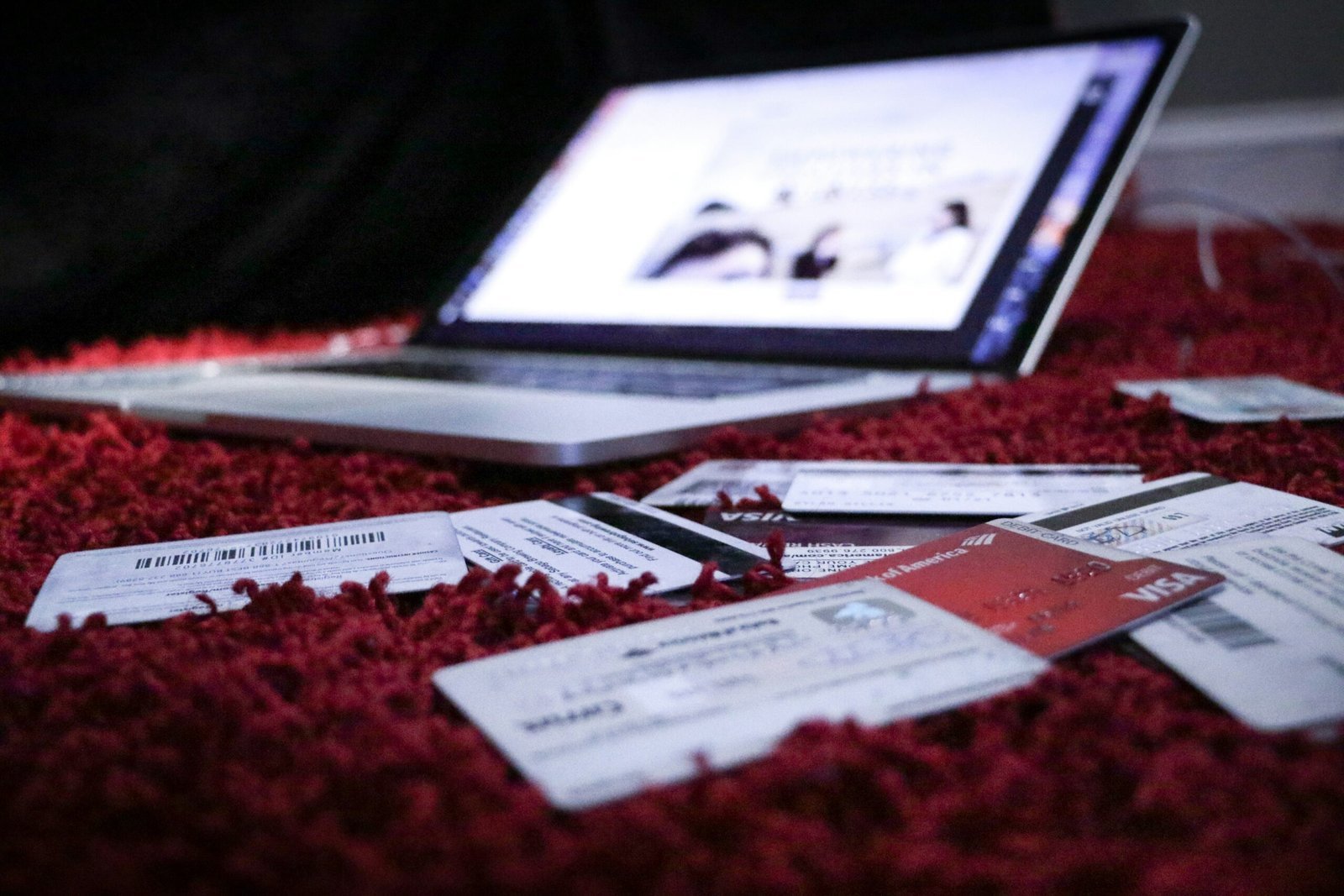

Risks and Considerations

Home equity loans can be a viable financing option for homeowners looking to access the value of their property. However, it is essential to carefully consider the associated risks before proceeding. One significant risk is the possibility of foreclosure. Since these loans are secured against the home, if the borrower fails to make the required payments, the lender may take legal action to reclaim the property. This emphasizes the importance of evaluating your ability to repay the loan before committing to such a borrowing strategy.

Another crucial factor to consider is the impact on credit scores. Taking out a home equity loan increases overall debt, which can affect your credit utilization ratio. If borrowers do not manage their debt levels carefully, they may see a decline in their credit scores, potentially making future borrowing more challenging or expensive. Understanding how a home equity loan influences your credit profile is vital to making an informed decision.

Additionally, homeowners should account for the long-term financial implications of borrowing against home equity. A home equity loan often comes with closing costs and fees, which can add to the initial borrowing burden. Moreover, fluctuating interest rates may affect the loan payments; rising rates can lead to higher monthly obligations, thus straining a homeowner’s finances over time.

Therefore, it is crucial to read the fine print of loan agreements thoroughly. Many agreements include various clauses that can impact the loan’s overall cost and terms. Misunderstanding specific conditions may lead to unexpected financial strain. By recognizing these factors and conducting appropriate research, homeowners can better navigate the complexities of home equity lending, ensuring that decisions align with their financial circumstances and goals.

How to Qualify for a Home Equity Loan

Qualifying for a home equity loan involves meeting specific criteria that lenders use to evaluate potential borrowers. Understanding these requirements is crucial for homeowners considering leveraging their home’s equity. One key factor in this process is the loan-to-value (LTV) ratio. The LTV ratio is calculated by dividing the amount of the loan by the appraised value of the property. Generally, lenders prefer an LTV ratio of 80% or less, which allows homeowners to retain a portion of their equity while borrowing against their property.

Another significant criterion is the borrower’s credit score. Most lenders require a minimum credit score, often around 620 or higher, to qualify for a home equity loan. A higher credit score is beneficial as it demonstrates the borrower’s reliability in repaying debts, thus enhancing their chances of securing favorable loan terms. Alongside credit scores, lenders examine income verification to ensure that borrowers have a stable income to meet repayment obligations. It is typically necessary for applicants to provide documentation, such as pay stubs, tax returns, and bank statements, to prove their financial standing.

Additionally, lenders assess the debt-to-income (DTI) ratio, which compares a borrower’s monthly debt payments to their gross monthly income. A lower DTI ratio, preferably 43% or less, indicates that the borrower has a manageable amount of debt in relation to their income. To improve chances of obtaining a home equity loan, homeowners can focus on increasing their credit score, reducing existing debt, and ensuring their income level meets the lender’s requirements. By addressing these factors proactively, borrowers position themselves favorably for approval in the home equity loan application process.