What Is a Credit Score?

A credit score is a numerical representation of an individual’s creditworthiness, serving as a risk assessment tool primarily used by lenders. This score typically ranges from 300 to 850, with higher scores indicating better credit reliability. Credit scores are essential for various financial activities, including applying for loans, mortgages, and credit cards, as they help lenders determine the likelihood of an individual repaying borrowed funds.

The calculation of a credit score is influenced by several key factors. These include payment history, which accounts for approximately 35% of the score, and total debt utilization, which reflects credit card balances in relation to credit limits and contributes about 30%. Other elements include the length of credit history, types of credit accounts, and new credit inquiries. Each of these components plays a crucial role in shaping an individual’s overall score, highlighting the importance of maintaining good credit practices over time.

There are different scoring models available, the most notable being FICO and VantageScore. While both systems utilize similar factors to calculate scores, they may weigh these factors differently, resulting in slight variations in the final score. Understanding which scoring model is used by a lender can provide individuals with insights into how their creditworthiness is perceived.

Understanding your credit score is essential for maintaining financial health. A strong credit score can open doors to favorable loan terms, lower interest rates, and increased borrowing capacity. Conversely, a low score may hinder access to financial products or lead to higher costs. By keeping an eye on one’s credit score and recognizing the factors that influence it, individuals can take proactive steps to enhance their creditworthiness, ultimately contributing to greater financial freedom.

The Importance of a Good Credit Score

A good credit score is a critical component of one’s financial health, influencing numerous aspects of daily life. Essentially, a credit score reflects an individual’s creditworthiness, serving as an indicator to lenders about the risk associated with lending money or extending credit. Most significantly, individuals with high credit scores are often rewarded with several financial advantages.

One of the primary benefits of maintaining a good credit score is access to lower interest rates on loans. Lenders tend to offer more favorable terms to applicants who demonstrate responsible credit management, allowing borrowers to save substantial amounts over the life of a loan. For example, a slight difference in interest rates can have a significant impact on monthly mortgage payments, making it essential for potential homeowners to strive for a good score.

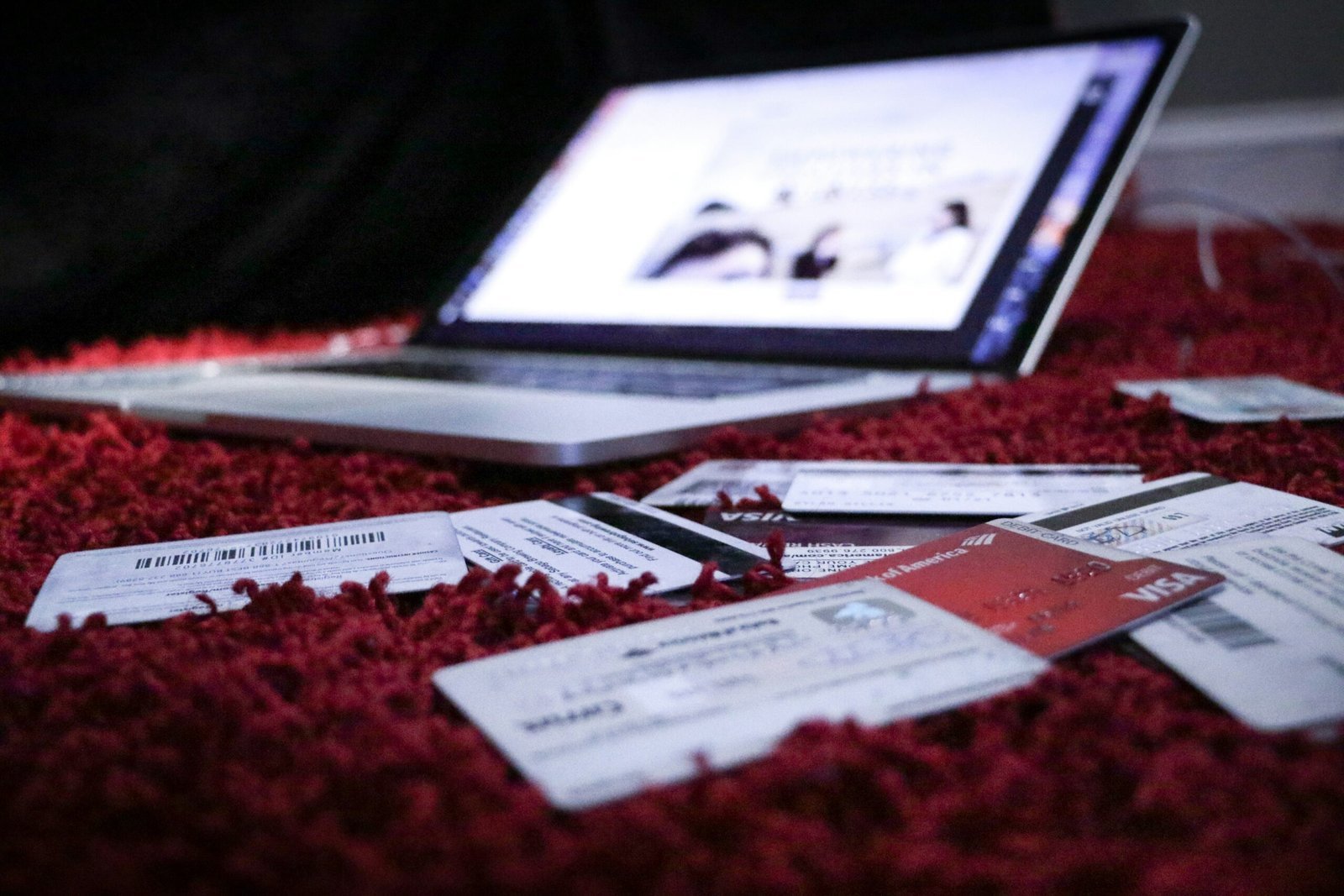

Additionally, a robust credit score improves the chances of approval for various credit products, including credit cards. Credit card companies are inclined to issue lines of credit to customers who exhibit strong credit histories, thereby enhancing spending power and providing more financial flexibility. Furthermore, credit scores play a crucial role in leasing agreements, as landlords often review applicants’ scores before approving rental applications. A high credit score may result in favorable leasing terms, such as lower deposits and reduced rental rates.

Conversely, a poor credit score can lead to detrimental consequences. Individuals with low scores may face difficulties securing loans or may be subjected to higher interest rates, reflecting the greater risk that lenders perceive. Additionally, those with poor credit histories may encounter obstacles when attempting to rent homes, as landlords may choose to reject applications from those with less favorable scores. Thus, it is evident that the importance of a good credit score extends far beyond mere numbers; it influences individuals’ overall financial wellbeing and future opportunities.

How to Improve Your Credit Score

Improving your credit score is a vital step towards securing financial freedom. A high credit score not only enhances your borrowing capacity but can also lead to lower interest rates and better loan terms. To effectively elevate your credit score, consider adopting the following strategies.

One of the most fundamental practices is ensuring that all your bills are paid on time. Late payments can have a detrimental impact on your credit score, as payment history constitutes a significant portion of your credit evaluation. Setting up automatic payments or reminders can help you stay on track and avoid missed due dates.

Additionally, managing your credit card utilization is crucial. Experts recommend keeping your credit card balances below 30% of the credit limit. Higher utilization rates can signal risk to lenders, thereby adversely affecting your credit score. Once you have reduced your balances, it’s advantageous to maintain a consistent payoff schedule to reinforce this positive behavior.

Another important aspect to consider is minimizing unnecessary credit inquiries. Each time you apply for credit, a hard inquiry is recorded on your credit report. Multiple inquiries in a short period can negatively impact your score as they may indicate financial distress. When contemplating new credit, ensure it aligns with your financial goals and assess your current situation carefully.

Regularly checking your credit reports can help you identify and correct any errors that may be lowering your score. If you find inaccuracies, address them immediately to prevent long-term negative implications. By checking your credit reports at least once a year, you can stay informed about your credit standing and take necessary actions when needed.

Lastly, building a positive credit history takes time. Consider diversifying your credit portfolio by including a mix of credit types, such as installment loans and revolving credit, thereby demonstrating your ability to manage different credit forms effectively. By following these strategies consistently, you can gradually improve your credit score and pave the way for financial stability.

Monitoring and Maintaining Your Credit Score

Monitoring and maintaining your credit score is an essential practice for anyone aiming to secure their financial future. A credit score acts as a numerical representation of your creditworthiness, influencing your ability to secure loans, mortgages, or even rental agreements. Regularly tracking your credit score can ensure that you understand where you stand and help you make informed financial decisions. Fortunately, various tools and services are available that make this task manageable.

Many financial institutions, such as banks and credit unions, offer free credit score monitoring services to their clients. Alternatively, several independent websites and apps provide insights into your credit score changes, allowing you to receive updates and alerts. These platforms often deliver comprehensive credit reports that detail your credit history, outstanding debts, and payment behavior. Understanding your credit report is crucial, as it highlights areas where you may improve and identifies factors negatively affecting your score.

Setting up alerts is another proactive measure worth considering. Many credit monitoring services enable users to establish notifications for significant changes to their credit reports. For example, alerts can be set to notify you of new credit inquiries, late payments, or updates to existing accounts. This feature can help you react swiftly to any irregularities, whether they result from fraud or a legitimate error. By catching these issues early, you may prevent long-term damage to your credit score.

Ultimately, regular monitoring and maintaining your credit score empower you to take control of your financial health. By staying informed about your credit status, understanding how to interpret your reports, and utilizing the tools available, you can effectively manage your credit and work towards achieving financial freedom.